How to Determine if a Deduction is Pre/Post Tax

When loading payroll history in the application, some deductions will not be listed as Pre/Post tax on the prior payroll provider payroll reports. You can use the deduction models article to differentiate the deduction types and how they are taxed.

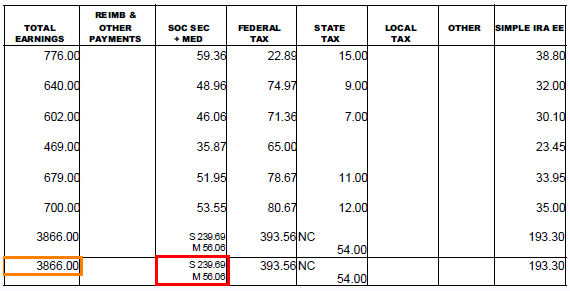

You can multiply the gross pay by the Social Security or Medicare rate to see if the answer matches the tax amount that was deducted from the employee's gross pay. If it matches it is a Post Tax deduction. If it does not match then it is a Pre-Tax deduction. Note, keep in mind about rounding.

Payroll History Example:

Pre-Tax (Before Taxes): Usually Doesn't Match

3866 x 1.45% = 56.057

OR

3866 x 6.2% = 239.692

Post Tax (After Taxes): Matches

3866 x 1.45% = 56.057

OR

3866 x 6.2% = 239.692